Indicators on Check Cash Payday Advance Loans You Should Know

Wiki Article

Check Cash Payday Advance Loans Fundamentals Explained

Table of ContentsExamine This Report on Check Cash Payday Advance LoansCheck Cash Payday Loans Can Be Fun For EveryoneNew Direct Loans for DummiesFascination About Check Cash Payday Advance Loans

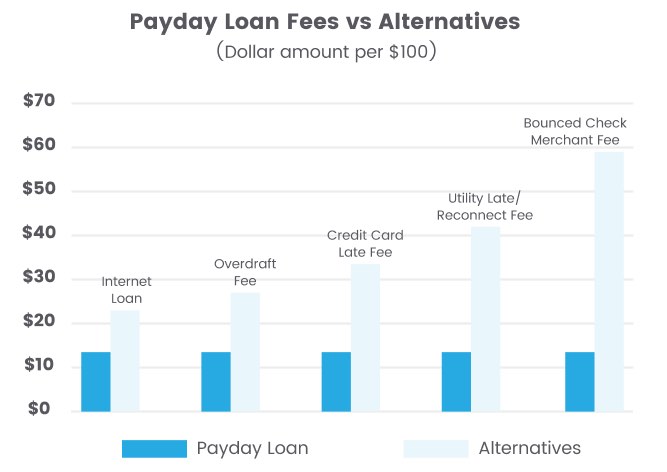

A $15 cost per $100 obtained is rather normal. A $15 charge on a $100 finance might not seem like a lot. On a two-week loan, that functions out to an annual portion rate (APR) of virtually 400%. Payday advance loan are among one of the most costly resources of customer credit.

17% as of February 2022. For a 24-month personal lending, the average APR was 9. 41%, according to the Federal Reserve. Pro Pointer Payday advance are prohibited or seriously restricted in 18 states and the District of Columbia, according to The Bench Charitable Trust Funds. Other states have varying degrees of safeguards.

That implies Amy requires to come up with $300 fast. She goes to a storefront payday lender and also applies for a $300 finance this month while she figures out exactly how to address her monthly shortfall. To borrow $300, Amy has to pay a $45 financing cost. That doesn't seem like a great deal.

The 3-Minute Rule for Check Cash Payday Advance Loans

That means Amy is paying an APR of nearly 400%. When the lending comes due, Amy does not have $345. The cash she obtained went towards her higher lease as well as childcare expenses. So she pays a $45 charge to surrender the car loan. She currently has spent $390 on her $300 finance - https://ouo.io/1E9M4.Lots of economic institutions will certainly also charge you a fee. But at the minimum, you can stop the loan provider from taking cash you need for basics, like lease or food. Keep in mind that when you request on-line payday advance, it's typically tough to inform if you're applying with a real loan provider or a lead generator that sends your info to loan providers.

Some states need lending institutions to offer consumers a layaway plan without billing extra charges. In various other states, loan providers need to enable having a hard time consumers to enter a repayment strategy, however they're allowed to tack on extra charges. No matter your state's legislation, it frequents a lender's rate of interest to collaborate with you.

An additional choice is to tell the loan provider you're so overwhelmed by costs that you're considering personal bankruptcy. Numerous lending institutions are willing to compromise in this situation because they know it's most likely they would not obtain anything in personal bankruptcy court.

Direct Payday Loans Things To Know Before You Get This

If you need $200, after that the check will be for $230. Despite the fact that payday loan providers call this charge a cost, it has a 391% APR (Interest Rate) on a two-week lending. Approximately $550. When the loan provider makes the finance he must tell you in composing just how much he is billing for the financing as well as the APR or interest price on the financing.You can just have one payday funding at a time. That financing must be paid in full before you can takeout one more. When the loan provider makes the financing he will certainly have to put your information into an information base made use of only by various other cash advance loan providers and also the state company that watches over them.

If you still owe on a payday advance loan and also most likely to one more loan provider, that lender will certainly inspect the data base as well as by law have to refute you the funding. When you settle your payday advance, you can get a new one the next service day. After you obtain 7 payday fundings straight, you will certainly need to wait 2 days before you can takeout a new funding.

They can not also tell you that you can be arrested or put in jail. If your check doesn't clear, then your financial institution will certainly bill you for "bouncing" a check, as well as the lender can bring you to Civil Court to collect the cash you owe. Of training course, if a payday loan provider transfers the check, it could cause other checks you have composed to jump.

Fast Payday Advance - An Overview

Box to you. They might additionally approve your utility expense settlements without billing a charge. Yes, and a lot of them do. With normal checkcashing, the business does not "hold" the check before cashing it, however cashes it quickly for a fee. They might cash your own personal check or a check constructed out to you by somebody else.

If you want to cash a preprinted income or government look for $150 or less, after that they can charge you $3. 00 or 2% of the check's Stated value, whichever is greater. That implies, for all checks much less than $150, they can charge you $3. 00, as well as if the check is for more than $150, then they'll charge you 2% of its worth.

Report this wiki page